Stimulus Payment Information

As many of our customers are beginning to receive stimulus payments, please note that PrimeSouth Bank is unable to check the status of our customers' stimulus payments. However, you can check your account to see if it is pending in your online banking or your mobile app.

For more information and to check the status of your payment with the IRS, visit: https://www.irs.gov/coronavirus/get-my-payment

COVID-19 Branch Update

Our lobbies are open, and we’d love to see you! However, if you prefer to bank with us remotely, our drive-thru services as well as our Mobile, Online Banking and ATMs continue to be available. Please explore our website to access details about the convenient tools we offer to continue banking during unforeseen circumstances.

The safety of our employees and customers are of the utmost importance. As we closely monitor the situation and adhere to recommendations from the CDC, any updates will be issued on our website and Facebook.

For additional information about COVID-19, visit the Centers for Disease Control and Prevention at cdc.gov.

Let’s Work Together to Help Keep Your Account(s) Safe

With the uncertainty surrounding the COVID-19 Coronavirus impact, we have heard of fraud and scam activity in our area. One scam in particular involves fraudsters using the name of the Federal Deposit Insurance Corporation to con their victims. The perpetrator claims to be a specific FDIC employee and asks for account numbers, Social Security numbers, dates of birth and other details that can be used to commit fraud or sell a person’s identity. They may email, call, text, fax or contact you via social media. The FDIC urges people not to be fooled.

Other confirmed incidents include:

- Emails regarding mail service and pharmacy orders. In this situation, the email urges you to click on a link. If this happens, call the business directly before you click.

- "Fake bank alerts" sent to customers claiming that their account is suspended due to COVID-related shutdowns or alerting customers of service changes. These “alerts” include a website link, set up by the scammer, that asks customers to enter their bank credentials.

- The “grandparent scam.” Targets will get a call or email from someone claiming to be a friend or relative stating that they’re stuck in a foreign country and need funds wired immediately to their bank account.

- "Fake charity donations." Not only can these scams take money, but also checking account, credit card, and other financial information for later misuse.

- Requests sent through social media and cash payment systems such as Cash App, Google Pay, Venmo, and Zelle®.

Here’s what you do to keep from being a victim:

- Sign up for Balance Alerts. This will tell you if there’s a significant change in your account balance.

-

- Alert Set-Up Steps Step 1: Login to Online Banking Step 2: Click on the "Menu" bar to the right Step 3: Click on "Customer Service" Step 4: Click on "Alerts" and select what appeals to your needs Step 5: Click "Update"

- Click here to enroll in Online Banking.

- Do NOT send payments via Cash App, Google Pay, Venmo, and Zelle® to people you do not know. These services are for you to pay friends and family only.

- What is Zelle®? Click here to learn more.

- Verify any requests for money via social media (Facebook, Facebook Messenger, etc.) Pick up the phone and call the person requesting the money or asking you to click on a link. Use a number that you are certain belongs to that person. If you cannot verify the sender information, delete or ignore the request.

- If you are approached via email or social media with a way to make money electronically, beware. If it sounds too good to be true, it most likely is.

- While it is always a safe practice to question any emails with incorrect grammar, spelling, or capitalization, please note that fraudsters are more savvy at this time. We encourage everyone to take extra time to verify an email's legitimacy via proper channels.

- Use a Different UserName and Password for Your Bank Account

- In case one of your other online accounts is breached, you wouldn’t want it to have the same username and password as your bank account. Review your PrimeSouth username and password to make sure they’re unique.

- Make Sure Your Contact Information Is Up To Date:

- Having your up-to-date info, like your mobile phone number and a valid email address, ensures we can contact you quickly if we notice suspicious activity. This is a powerful way to fight fraud. Just sign into your online account to verify your current information.

One of the most important things you can do to protect yourself from becoming a victim of fraud is to never give out your personal information to anyone if you are unsure. If we contact you, we'll always use your name or account number - we wouldn't ask for your account information, Social Security number, debit card PIN or password. If you mistakenly give out your personal information, please notify the bank immediately so that we can do our best to help keep you and your money safe. Click here to contact us.

Click to Find Out More Ways to Safeguard Your Account

Digital Banking Tips

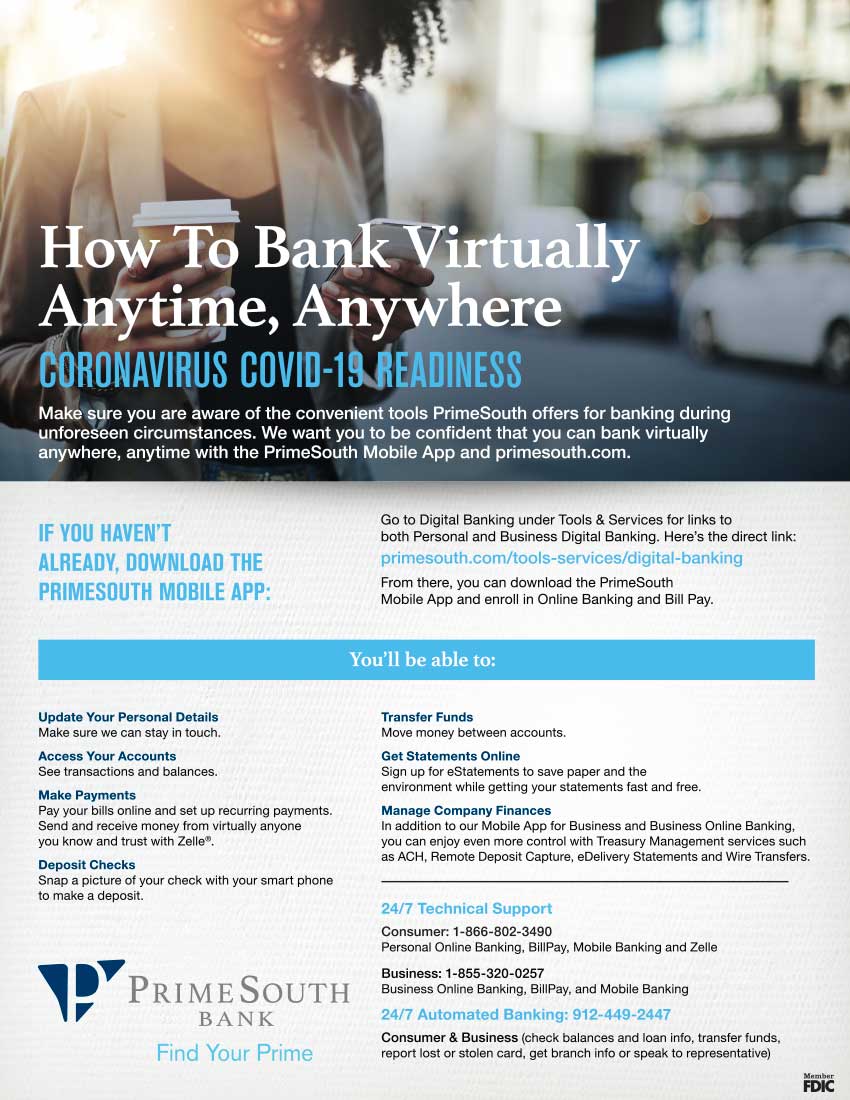

We understand that access to your account(s) is important and we will continue to provide high-quality customer service. Our ATMs, online banking, and mobile services are conveniently available. Additionally, we are providing limited access to our lobbies by appointment only.If you have not yet enrolled, the process only takes a few minutes. Click to begin.

You will have access to:

Personal Online Banking

- See transactions and balances, access e-Statements, and other important information

- Transfer Funds

- Online Secure Bill Payment

Personal Mobile Banking

- All the same functions as Online Banking with the benefit of Mobile Deposit

- Send and receive money from virtually anyone you know and trust with Zelle

Access These Tools Here

Personal Banking - Click to Enroll

Commercial Online Banking

- Detailed account activity and history

- Export transaction data to financial software

- Save time and money with Online Bill Payment

- Treasury Management Solutions including e-Wire, Remote Deposit Capture, and ACH Origination

Commercial Mobile Banking

- View balances and transactions, transfer funds, pay bills, and deposit checks

- Download Our App

Access These Tools Here

______________________________________________

Mobile Deposit Steps:

Step 1: Login to Our App

Step 2: Click the Plus Sign (+) at the bottom right

Step 3: Click "Deposit" then "Continue"

Step 4: Read the information then click "Continue"

Step 5: Click on "Front" and take a photo of the front of the check. Click "Back" and take a photo of the back of the check*

Step 6: Click on "Deposit" and select desired account

Step 7: Click "Amount", enter, and click "Done" at top right

*Please endorse with Customer Name, Customer Account Number and “for mobile deposit only”. Note: all deposits are subject to bank review and mobile deposits made after 4pm will be processed the next business day.